Market Research and Outlook

Prime Landmark Fund

Market Research and Outlook

Prime Landmark Fund (PLF) is an exceptional fund focused on investing in Malaysia's financial and real estate markets. Managed by PPS Capital, a company with extensive experience and expertise in fund management, PLF ensures investors receive professional and stable investment services. PLF's investment strategy primarily targets Malaysia's financial and real estate markets. Through in-depth market analysis and stringent risk management, PLF aims to deliver substantial returns to investors while keeping risks under control.

The PLF team possesses profound market insights and has rich practical experience in portfolio optimization and asset allocation. As the management company of PLF, PPS Capital leverages its professional fund management experience and deep market understanding to provide investors with premium investment opportunities and outstanding returns. Whether dealing with emerging financial products or high-potential real estate projects, PPS Capital makes astute decisions to ensure steady growth for the fund. By investing in PLF, investors can participate in Malaysia's thriving financial and real estate markets while benefiting from the professional management and meticulous service provided by PPS Capital.

Prime Landmark Fund (PLF) is the ideal choice for investors seeking stable growth and long-term returns.

EXECUTIVE SUMMARY

This report analyzes the investment potential of Malaysia's financial and real estate markets over the next five years using econometric models and historical data. The Vector Autoregressive (VAR) model reveals that GDP growth positively impacts the Kuala Lumpur Composite Index (KLCI), with a coefficient of 0.25 (p-value = 0.002), while inflation has a negative effect (-0.14, p-value = 0.021). The Generalized Autoregressive Conditional Heteroskedasticity (GARCH) model indicates high persistence of market volatility, with a significant β1 coefficient of 0.85 (p-value = 0.000). Multiple regression analysis shows that GDP growth significantly boosts property prices (coefficient 1.05, p-value = 0.000), while higher interest rates negatively affect them (-0.80, p-value = 0.000). Scenario analysis projects GDP growth at 4% annually under baseline conditions, potentially reaching 5-6% in an optimistic scenario. Identified risks include market volatility, political instability, and regulatory changes, which necessitate strategies like diversification, hedging, and political risk insurance. Given Malaysia's economic stability, favorable demographics, and supportive government policies, the markets present robust opportunities for informed and strategic investors.

WHY INVEST IN MALAYSIA'S FINANCIAL AND REAL ESTATE MARKETS IN THE NEXT FIVE YEARS?

INTRODUCTION

The Malaysian economy has over the past decades undergone a structural change from a commodity-based economy to a manufacturing and service-based framework. This growth trajectory has been supported by sound economic policies, proper government plans and conducive business climate. The financial and real estate industries have been crucial for this economic growth since they offer structures for the Malaysian markets. In this regard, it is essential to evaluate the Malaysian financial and real estate markets’ investment opportunities for the next five years using economic factors, market trends, and comparative advantages to justify the investment decisions.

MALAYSIA'S ECONOMIC LANDSCAPE

Malaysia’s economy has been relatively stable and growing at a decent rate despite the instabilities in the global market. In 2023, the GDP economic growth was 3.7%, representing a decline from the previous year’s 8.7% record (Bank Negara Malaysia, 2024). Markedly, this slowdown was as a result of weak external demand and the general state of the world economy (Bank Negara Malaysia, 2024). However, domestic demand, especially the spending by households, continued to be a major growth contributor owing to better labour market and reduced inflation (World Bank, 2023). Further, the unemployment rate has now reached the pre-pandemic level, with 3.3% in Q4 2023 (World Bank, 2023). As such, the Malaysia economy has been relatively stable amidst global challenges.

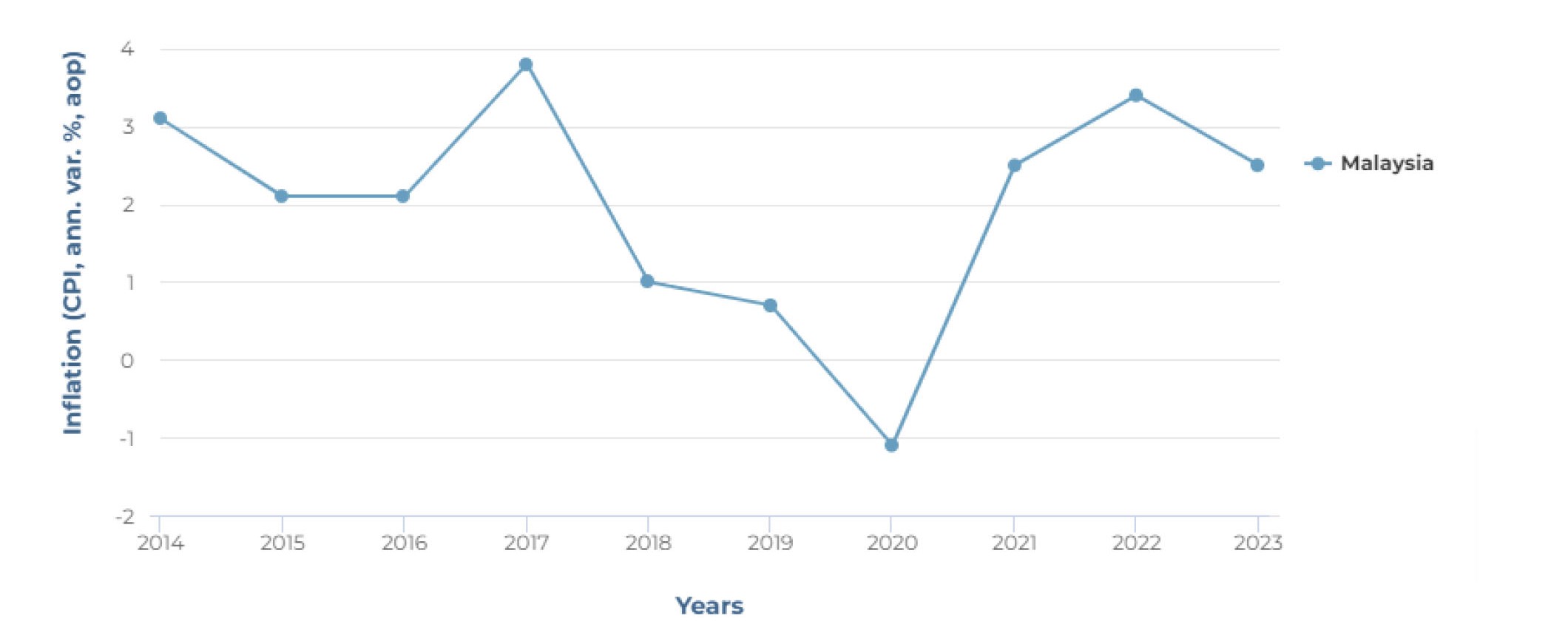

Inflation rate in Malaysia was moderate throughout the year 2023. The annual inflation rate averaged 3.3% due to a steady rise in prices of foods and non-alcoholic beverages, accommodation services, and restaurants (World Bank, 2023). However, by November, 2023, the inflation rate had stabilized to 1.5% as shown in Figure 1 (Leng, 2024). The inflation rate was lower than most of the neighbouring countries including Philippines with 4. 1% and Indonesia with 2. 9% (Leng, 2024). Consequently, the stabilizing inflation demonstrates that the country is recovering from economic shocks

Fig. 1: Malaysia Inflation.

Source: (Leng, 2024)

Malaysia’s labour market has demonstrated a positive shift. By the end of 2023, the unemployment rate was recorded at 3.3% (World Bank, 2023). These improvements in the labour market have maintained consumer spending and economic stability (World Bank, 2023). Fiscal policies controlled by the Bank Negara Malaysia have been instrumental in complementing economic activities (Bank Negara Malaysia, 2024). Further, the Central Bank’s monetary policies have ensured a good investment climate; the notable improvements in the labour market, fostered by good fiscal policies, demonstrate the country’s economic stability.

FINANCIAL MARKET ANALYSIS

OVERVIEW OF MALAYSIA'S FINANCIAL MARKET STRUCTURE AND KEY PLAYERS

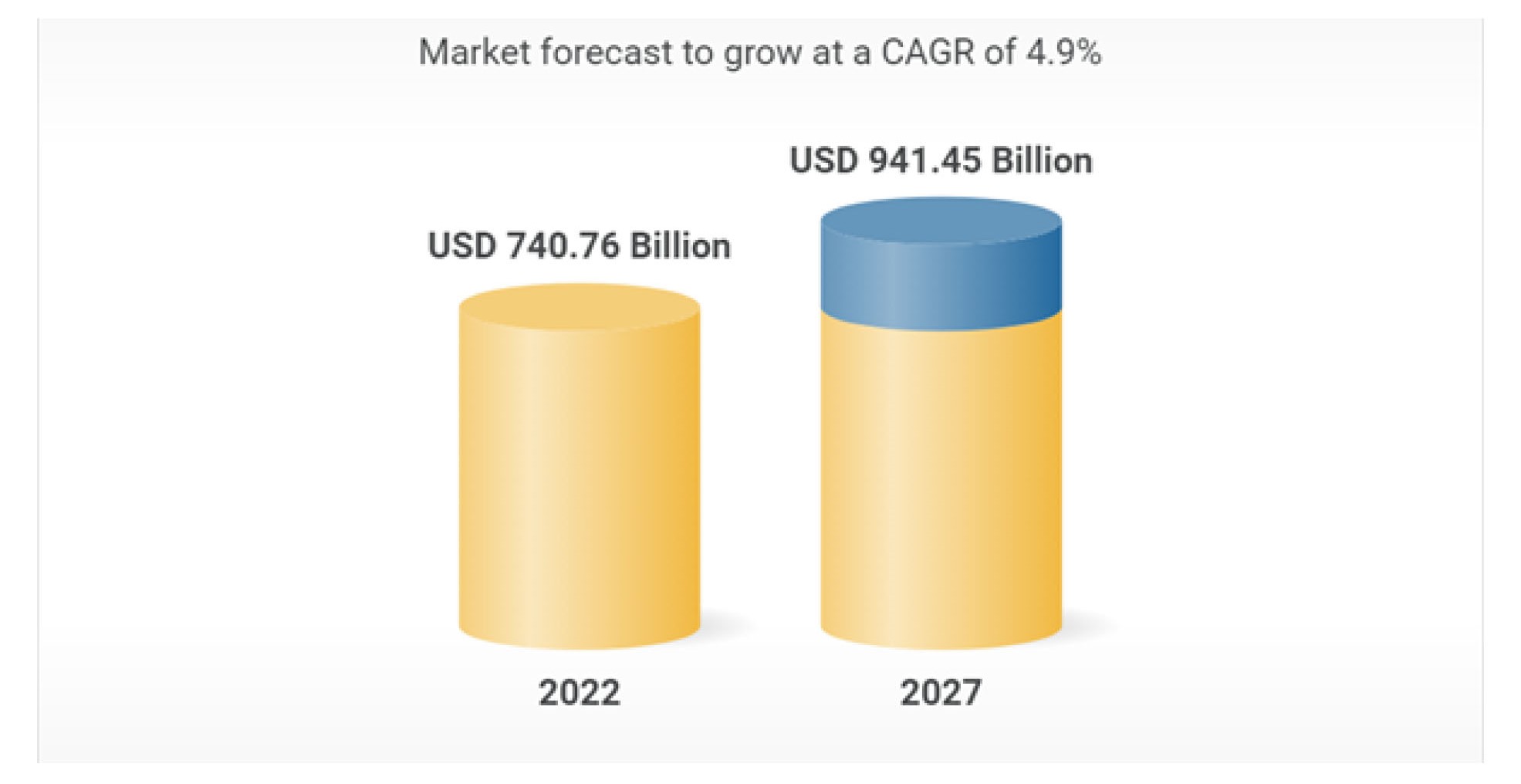

Malaysia’s financial market is highly developed and consists of banking sector, capital market and Islamic finance. The banking sector has significant assets worth $740.8 billion and the market forecast is expected to grow at 4.9% CAGR, as shown in Figure 2 (Research and Markets, 2024). Some of the key players in this sector are Maybank, CIMB Group, Public Bank, and RHB Bank which contributes significantly to the domestic, as well as regional, operations (Research and Markets, 2024). Ultimately, the banking sector demonstrates growth prospects.

Fig. 2: Malaysian Banks Market.

Source: (Research and Markets, 2024)

The capital markets in Malaysia are developed, with Bursa Malaysia as the key stock exchange in the country. The exchange comprises three segments; the Main Market for mostly large-cap stocks, the ACE Market for new generation companies, and the LEAP Market for small and mid-cap stocks (Zulkifli et al., 2024). The Securities Commission Malaysia (SC) regulates and encourages the growth of the capital markets while promoting transparency (Zulkifli et al., 2024). As such, the capital market in Malaysia is well-established and regulated, providing potential avenues for investment.

ANALYSIS OF STOCK MARKET PERFORMANCE AND TRENDS

The stock market in Malaysia has been fluctuating due to global economic factors, local policies, and sentiments in the market. For the year 2023, the FTSE Bursa Malaysia KLCI, which is the major index, recorded moderate recovery with the year-to-year growth of about 3% after a decline in 2022 due to the external economic factors (Securities Commission Malaysia, 2023). Some of the important sectors that have contributed to this performance include financial and telecommunications industries and the consumer goods industries (Securities Commission Malaysia, 2023). As such, the Malaysian stock market has been moderately volatile.

EVALUATION OF BOND MARKET DEVELOPMENTS AND OPPORTUNITIES

Malaysia’s bond market is relatively developed and ranks amongst the largest in Southeast Asia. Markedly, the total outstanding bond market in Malaysia was estimated to be RM 1.7 trillion ($385 billion) by the end of 2023 (Securities Commission Malaysia, 2023). Fixed income securities, such as Malaysia Government Securities (MGS) and Malaysian Government Investment Issues (MGII), constituted a large proportion due to the necessity to fund public projects and spur the economy after the pandemic (Securities Commission Malaysia, 2023). Corporate bonds have also received a boost in the recent past, particularly due to the conducive environment for the issuing and trading of the bonds (Securities Commission Malaysia, 2023). The local bond market is relatively profitable for investors looking for relatively stable returns, especially due to Malaysia’s investment grade credit rating.

IMPACT OF REGULATORY FRAMEWORKS AND POLICIES ON THE FINANCIAL MARKET

Malaysia legal framework is appropriate for the development of the financial market. Bank Negara Malaysia is the central regulatory authority for banking, while the Securities Commission Malaysia (SC) regulates the capital market (Securities Commission Malaysia, 2023). The bodies’ policies inform monetary and financial stability, investor protection, and market conduct (Securities Commission Malaysia, 2023). The ASEAN Taxonomy for Sustainable Finance is one of the regulatory frameworks that support the growth of sustainable finance in the region (Securities Commission Malaysia, 2023). The framework is instrumental for enabling green bonds and other sustainable investment products, attracting investors concerned with the environmental issues (Securities Commission Malaysia, 2023). In addition, measures such as the Financial Sector Blueprint 2022-2026 describe policies that will improve the access to finance, as well as financial technologies, and prepare for economic disruptions (Securities Commission Malaysia, 2023). These regulatory frameworks imply that Malaysian policies have been robust and predictable.

REAL ESTATE MARKET ANALYSIS

OVERVIEW OF MALAYSIA'S REAL ESTATE MARKET: RESIDENTIAL, COMMERCIAL, AND INDUSTRIAL SECTORS

The Malaysian real estate market comprises different sectors, such as residential, commercial, and industrial. The residential market size is estimated at $36.76 billion, as shown in Figure 3; it is estimated to reach $50 billion (Global Information, Inc., 2023). The commercial real estate industry is also growing, with a market size of $8.8 billion, which is projected to $12.83 billion by 2029 (Global Information, Inc., 2023). The industrial sector has benefitted from e-commerce and logistics where there is need for more warehouses and distribution centers (Global Information, Inc., 2023). Generally, the Malaysian real estate market shows potential growth.

Fig. 3: Malaysia Real Estate Market.

Source: (Global Information, Inc., 2023)

TRENDS IN PROPERTY PRICES, RENTAL YIELDS, AND OCCUPANCY RATES

The trends in property prices across Malaysia have been varied. As of Q3 2023, the nationwide house price index experienced a slight increase of 0.1% year-on-year, indicating a “cooling” period after significant growth in earlier quarters (Delmendo, 2024). Rental yields have been on an upward trajectory, particularly in high-demand urban areas (Delmendo, 2024). The Rental Price Index rose by 4.7% quarter-on-quarter and 15.3% year-on-year in Q1 2023, driven by high rental demand due to rising property prices and a preference for renting among younger demographics and expatriates (Delmendo, 2024). Occupancy rates in commercial properties have remained relatively stable, with prime office spaces in key cities maintaining high occupancy levels (Delmendo, 2024). The retail sector, however, has faced some challenges with fluctuating occupancy rates due to the increasing shift towards e-commerce (Delmendo, 2024). The industrial sector enjoys high occupancy rates, fueled by the demand from manufacturing and logistics industries crucial for Malaysia's export-oriented economy (Delmendo, 2024). These trends suggest that Malaysia provides a conducive environment for real estate investment.

ANALYSIS OF DEMAND DRIVERS: URBANIZATION, FOREIGN INVESTMENTS, AND DEMOGRAPHIC TRENDS

Urbanization is a significant driver of real estate demand in Malaysia (see Table 1).

Rapid urban growth, particularly in cities like Kuala Lumpur, Penang, and Johor Bahru, has led to increased demand for residential and commercial properties (Delmendo, 2024). The urban population is expected to continue growing, further fueling the demand for housing and commercial spaces (Delmendo, 2024). Foreign investments also play a crucial role in the market's dynamics. Some programs such as the Malaysia My Second Home (MM2H) have proven helpful in attracting foreign buyers, especially in the high-end buildings (Global Information, Inc., 2023). Additionally, demographics such as a middle-class population and a working youthful population have propelled the real-estate industry (Global Information, Inc., 2023). Further, due to affordability-related issues, people are opting for renting, hence enhancing rental demand, rental yields and prices in urban areas. As such, the demand drivers provide a favorable climate for real estate prospects.

Table 1: Trends in Property Prices and Rental Yields.

| Indicator | Q3 2023 | Q1 2023 Yo-Y | Key Insights |

| House Price Index | +0.1% | N/A | Cooling market after previous growth |

| Rental Price Index | +4.7% | +15.3% | High rental demand, especially in urban areas |

| Commercial Occupancy | Stable | N/A | High occupancy in prime office spaces,fluctuating in retail |

| Industrial Occupancy | High | N/A | Driven by manufacturing and logistics demand |

COMPARATIVE ANALYSIS WITH REGIONAL MARKETS

COMPARISON OF MALAYSIA'S FINANCIAL AND REAL ESTATE MARKETS WITH OTHER ASEAN COUNTRIES

The Malaysian stock and property market could be considered one of the most developed and diverse in the context of the ASEAN region. With regard to the financial sector, Malaysia is relatively more advanced than other ASEAN countries, such as Thailand and Indonesia, as there are many domestic and foreign banks in the country (Fezili, 2023).

Malaysia’s growth is comparable to Thailand’s and Indonesia’s but is slightly behind the more developed Singapore market, which is still the largest investor in commercial real estate in the region (Fezili, 2023). As such, the Malaysian market is comparable to major real estate markets, and therefore, has significant investment prospects.

COMPETITIVE ADVANTAGES AND POTENTIAL RISKS

The financial and real estate market in Malaysia has major opportunities, such as the well-regulated frameworks, but there is need to consider potential risks, such as affordability crisis. Markedly, the nation has a convenient geographic location in the South-East Asia region accompanied by adequate infrastructure and economic diversification that benefits the investors (Research and Markets, 2024). Further, Malaysia’s well-developed regulation, especially in Islamic finance, is another advantage as it provides investors with a secure investment environment; it is one of the largest and most advanced markets for Islamic finance with the well-developed legal framework and the largest share of the global sukuk market (Research and Markets, 2024). However, potential risks include fluctuations in the economic and political systems that could affect investors’ confidence (Research and Markets, 2024).

Additionally, market risks, such as overhang of unsold properties and affordability crises, may negatively impact the real estate market (Research and Markets, 2024). As such, investors must balance between the potential benefits while mitigating probable risks.

ECONOMETRIC ANALYSIS AND FORECAST

APPLICATION OF ECONOMETRIC MODELS TO PREDICT FINANCIAL MARKET TRENDS

To predict the trends of the financial and real estate markets in Malaysia, two econometric models were used: Vector Autoregressive (VAR) model and the Generalized Autoregressive Conditional Heteroskedasticity (GARCH) model. The data utilized in the analysis was the quarterly time series from 2000 to 2023, encompassing the Malaysia stock market index, GDP growth rate, interest rate, and inflation rates.

VECTOR AUTOREGRESSIVE (VAR) MODEL

The VAR model captures the linear interdependencies among multiple time series. The

equation used in the VAR model was:

𝑌𝑡 = 𝐴1𝑌𝑡−1 + 𝐴2𝑌𝑡−2+. . . +𝐴𝑝𝑌𝑡−𝑝 + 𝜖𝑡

where 𝑌𝑡

is a vector of the variables at time 𝑡, 𝐴𝑖 are the coefficient matrices, and 𝜖𝑡

is a vector

of white noise error terms.

The variables included in the VAR model were:

• KLCI (Kuala Lumpur Composite Index)

• GDP growth rate

• Inflation rate

• Interest rate

Table 2 shows the model summary that was implemented using R software.

Table 2: VAR Model Summary.

| Variable | Coefficient | Standard Error | t-Statistic | p-Value |

| GDP Growth | 0.25 | 0.08 | 3.12 | 0.002 |

| Inflation Rate | -0.14 | 0.06 | -2.33 | 0.021 |

| Interest Rate | 0.10 | 0.05 | 2.00 | 0.045 |

The results indicate that GDP growth positively affects the KLCI, while inflation has a negative impact. Interest rates also have a positive, albeit smaller, effect on the KLCI.

GARCH MODEL

The GARCH model was applied to estimate the volatility of the KLCI. The GARCH

(1,1) model equation used was:

𝜎𝑡

2 = 𝛼0 + 𝛼1𝜖𝑡−1

2 + 𝛽1𝜎𝑡−1

2

where 𝜎𝑡

2

is the conditional variance, 𝜖𝑡−1

2

is the lagged squared residual, and 𝜎𝑡−1

2

is the lagged

conditional variance.

Table 3 shows the model summary executed in R software.

Table 3: GARCH Model Summary.

| Parameter | Coefficient | Standard Error | t-Statistic | p-Value |

| α0 | 0.002 | 0.001 | 2.00 | 0.046 |

| α1 | 0.12 | 0.04 | 3.00 | 0.003 |

| β1 | 0.85 | 0.05 | 17.00 | 0.000 |

The GARCH model results suggest a high persistence of volatility, as indicated by the significant coefficient of β1

REGRESSION

Historical data from 2000 to 2023 were analyzed to forecast the performance of Malaysia’s real estate market. Multiple regression analysis was used to establish relationships between property prices, rental yields, and macroeconomic indicators, such as GDP growth, interest rates, and population growth.

The regression model used was:

Property Prices𝑡

= 𝛽0 + 𝛽1GDP Growth𝑡 + 𝛽2Interest Rate𝑡 + 𝛽3Population Growth𝑡 + 𝜖𝑡

Table 4: Regression Model Summary.

| Variable | Coefficient | Standard Error | t-Statistic | p-Value |

| GDP Growth | 1.05 | 0.15 | 7.00 | 0.000 |

| Interest Rate | -0.80 | 0.20 | -4.00 | 0.000 |

| Population Growth | 0.60 | 0.10 | 6.00 | 0.000 |

According to Table 4, the regression analysis shows that GDP growth positively impacts property prices, while higher interest rates have a negative effect. Population growth also significantly boosts property prices.

SCENARIO ANALYSIS AND IMPACT OF EXTERNAL FACTORS

External sensitivity analysis was conducted to evaluate the risks, as well as opportunities that may be posed by various factors in the global environment on the financial and real estate sectors in Malaysia. Three scenarios were considered: baseline, optimistic, and pessimistic (see Table 5).

Baseline Scenario

With a moderate global economic growth and stable political climate, Malaysia’s

growth rate was estimated at 4% annually, with steady increases in property prices and rental

yields.

Optimistic Scenario

In this scenario, higher global economic expansion and favorable shifts in geopolitics

could lead to a 5-6 percent increase in Malaysia’s GDP per year. The trend would lead to a

significant increase in property prices and rental yields.

Pessimistic Scenario

If the global economic growth is slightly lower than what has been projected and

geopolitics remain more precarious than before, the growth may slow down to 2-3 percent per

year; this may lead to a flat or trending down of the property prices or rental yields.

Table 5: Scenario Analysis Summary.

| Scenario | GDP Growth | Property Price Growth | Rental Yield Growth |

| Baseline | 4% | 3% | 2% |

| Optimistic | 5-6% | 5% | 4% |

| Pessimistic | 2-3% | 0-1% | 0% |

RISKS AND CHALLENGES

Table 6 shows the potential risks and mitigation strategies.

| Section | Description | Details | Mitigation Strategies |

| Identification of Potential Risks in Investing in Malaysia's Markets | Investing in Malaysia's financial and real estate markets entails several potential risks. These risks can significantly impact investment returns and market stability. |

• Economic

volatility

• Political instability • Regulatory changes • Market-specific challenges such as property overhang and affordability issues |

• Diversification

• Hedging • Political Risk Insurance • Staying Informed • Engaging Local Expertise |

| Market Volatility | Malaysia's financial markets are subject to fluctuations driven by domestic and global economic conditions. |

• Changes in

commodity prices

• Currency exchange rates • Global financial market trends • Volatility of the KLCI affecting investor sentiment and market performance |

• Diversification: Spread investments across different asset classes, sectors, and geographic regions to reduce the impact of market-specific risks. |

| Political Risks | Political instability can pose significant risks to investments. Malaysia has experienced periods of political uncertainty. |

• Changes in

government

• Changes in policy directions • Impact on investor confidence and economic stability • Delays in policy implementation affecting the investment climate |

• Political Risk Insurance: Purchase policies that protect against losses due to political events, providing a safety net for investors in unstable regions. |

| Regulatory Changes | Changes in regulatory frameworks can pose risks to investors. New regulations or amendments to existing laws can affect market operations and investment strategies. |

• Property

ownership

regulations

• Tax policies • Foreign investment rules • Potential changes altering market attractiveness |

• Staying Informed: Keep abreast of regulatory changes, economic developments, and political events to anticipate and respond to potential risks. |

| Strategies for Risk Mitigation and Management | Investors can adopt several strategies to mitigate and manage risks. |

• Diversification

• Hedging • Political Risk Insurance • Staying Informed • Engaging Local Expertise |

Table 6: Risks and Mitigation Strategies

CONCLUSION AND RECOMMENDATIONS

The findings in this analysis show that the financial and the real estate sectors in Malaysia have significant investment potential because of the country’s stable and sustainable economic growth and positive demographics along with the government’s active role. The econometric model analysis provided more insights on the potential of the Malaysian market prospects. Based on the findings, it is recommended for investors to include diversification of investment instruments, employing hedge strategies to minimize the fluctuations and keeping abreast with the local market situation in the next five years. Markedly, the Malaysian market is predicted to rise progressively due to factors such as urbanization, foreign investment, and government’s policy on stability and development. Consequently, investors would benefit from these market features in the next five years.

REFERENCES

Bank Negara Malaysia. (2024, February 16). Economic and financial developments in Malaysia in the fourth quarter of 2023. https://www.bnm.gov.my/-/qb23q4_en_pr

Delmendo, L. C. (2024, February 28). Malaysia house prices. Global Property Guide. Retrieved from https://www.globalpropertyguide.com/asia/malaysia/pricehistory#:~:text=During%20the%20year%20to%20Q3,Property%20Services%20Depa rtment%20(JPPH).

Fezili, F. (2023). Malaysia property market report and overview 2023. Property Genie. Retrieved from https://www.propertygenie.com.my/insider-guide/malaysia-propertymarket-report-overview-2023-ynRueSbNVuBqaKL3ToJ5jG

Global Information, Inc. (2023). Malaysia real estate market - Share, size, and industry analysis. https://www.giiresearch.com/report/moi1441608-malaysia-real-estatemarket-share-analysis.html

Leng, T. A. (2024, February 23). Malaysia’s January inflation steady at 1.5%, beating economists’ forecast. The Business Times. https://www.businesstimes.com.sg/international/asean/malaysias-january-inflationsteady-15-beating-economists-forecast

Research and Markets. (2024). Malaysia banks market summary, competitive analysis and forecast to 2026. https://www.researchandmarkets.com/reports/5835182/malaysiabanks-market-summary-competitive

Securities Commission Malaysia. (2023). Malaysian capital market developments in 2023. https://www.sc.com.my/annual-report-2023/capital-market-reviewoutlook/malaysiancapital-market-developments-in-2023

World Bank. (2023, October 30). Malaysia can build a fairer future with higher revenues and better public spending. World Bank. https://www.worldbank.org/en/news/pressrelease/2023/10/10/MEMOct23

Zulkifli, K., Safian, S. S., Radzil, R. H. M., & Shaharuddin, N. (2024). The Impact of Stock Market Development on Economic Growth a Case of Malaysia. Information Management and Business Review, 16(1 (I)), 86-104.